Are you planning to churn out a risk response plan with a comprehensive insurance policy? Here are a few important points that would help you understand why choosing a liability insurance cover is so beneficial. Take a look and live our life to the fullest by buying a 360 degree cover for your finances.

Liability insurance might sound a little new to many investors. In fact, people are still in two minds about whether they need it or not. The answer is always in positive. A general liability insuarnce is a comprehensive financial cover for every car or two-wheeler owner. On and off road, there are thousands of potential risks that could make your personal finances upside down. In order to pay third party damage or compensate third loss due to death or bodily injuries, this plan is of great help.

Here's You find All About Liability Insurance-

Key Highlights-

- Support Round The Clock: To safeguard your finances during emergencies, you need a dedicated support team that helps claim benefits on time. This insurance plan helps reap benefits at the right time and all you need to do is to talk the experts and find a solution provider that helps an insured at anytime.

- Helps Save Time: With the advent and rising popularity of digital platforms, every buyer now saves time by doing a research online, comparing plans and paying the premiums on time online. It simply saves time and cuts the lengthy process short.

- Own A Policy Instant: The time gap between buying a cover and the time for a valid coverage starts at a time if one buys a plan online. Moreover, a buyer can always own a policy within a wink this way.

Features-

A comprehensive business liability insurance offers two types of covers. One is for meeting third party liability and the second one is for the owner-driver personal cover.

This plan covers losses both in terms of death and damage to property of a third party that involves a vehicle insured. Any bodily injury or third party injury, death or damage to third party vehicles- every small risk is covered with a plan for liability management.

There is another cover available to owners or drivers of a vehicle that is covered with a general liability insurance. It offers a mandatory cover of INR 2 Lakhs for the owner-driver in case the vehicle is privately owned. In case of a business vehicle, the cover of INR 1 Lakh that covers death due to accidents or any permanent disability.

Exclusions-

Any claim that arises out of any contractual liability is not covered under this plan. Death or bodily injuries due to or in course of employment, is not cover under this plan either. Any person who dies or sustain injuries while dealing in nuclear weapons can't claim any benefit from this plan.

The Bottom Line-

In order to get the best liability insurance policy, all you need to do is to compare general liability insurance quotes and choose one that best suits your pocket. Moreover, there are many brands that offer this type of insurance these days. This is why you get a plan of this type at competitive rates. And there's another side to the coin- due to the skyrocketed competitions the coverage has become more comprehensive, cost-effective and on time.

Do a research online today and stay covered all the time. With a liability cover plan, you can now simply drive your life with complete peace of mind.

About The Author:

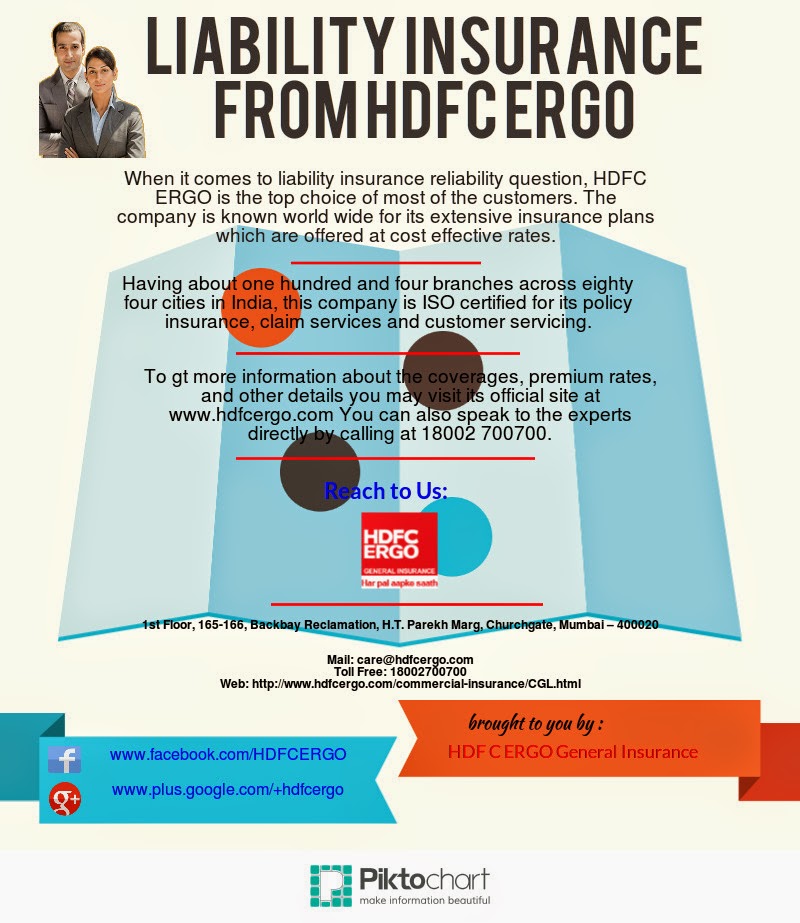

Sahil Doshi is a finance writer and has been writing on topics related to Insurance, that help buyers to choose better policy for them. He offers original case studies, stats and solutions through his writings. In this article he focuses on benefits of a liability insurance policy. For details visit: www.hdfcergo.com/commercial-insurance/CGL.html.

0 comments:

Post a Comment